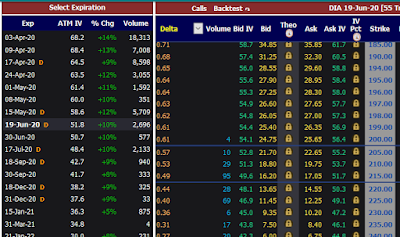

3-30-2020 DIA covered calls June 2020

First try and dry trade on 3/30

I bought DIA 100 shares at $223 for total of $23,000 and sold 1 covered call contract against it with strike $220 and expiration June 2020 for $2200 premium, Theoretically if my shares stay above $220, they can get assigned and I have to sell them for $22,000 + 2,200 premium but minus $300 difference between buy/sell prices = $1,900 profit within about 80 days on $23,000 investment, that is about 8.25 % profit if call get exercised .

Losing situation is possible if price of stock goes below $201 a share and I sell it below that price without selling another covered call contract against it.

Let see what happens on June 19th when this option expire.

This is an example of possible trades on covered call options of DIA SPDR DOW JONES INDUSTRIAL AVERAGE ETF TRUST

I did some research and appears to me that selling covered call options on indexes make a lot of sense and have good income potential with very limited risk.

Any questions, please use Comment Form Here . Thx

I bought DIA 100 shares at $223 for total of $23,000 and sold 1 covered call contract against it with strike $220 and expiration June 2020 for $2200 premium, Theoretically if my shares stay above $220, they can get assigned and I have to sell them for $22,000 + 2,200 premium but minus $300 difference between buy/sell prices = $1,900 profit within about 80 days on $23,000 investment, that is about 8.25 % profit if call get exercised .

Losing situation is possible if price of stock goes below $201 a share and I sell it below that price without selling another covered call contract against it.

Let see what happens on June 19th when this option expire.

This is an example of possible trades on covered call options of DIA SPDR DOW JONES INDUSTRIAL AVERAGE ETF TRUST

I did some research and appears to me that selling covered call options on indexes make a lot of sense and have good income potential with very limited risk.

Any questions, please use Comment Form Here . Thx

Comments

Post a Comment