3/31/2020 DIA covered calls April 9th

D trade

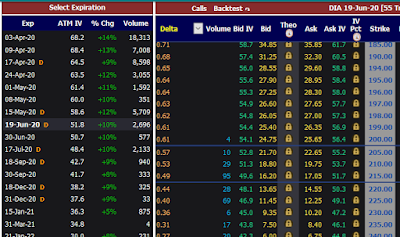

Short term covered call contract on $219.45 DIA long position with strike $215 for premium $1100.

Expiration date 04-09-2020, Thursday, that's just 7 trading days away

Possible Income 2.98 %

Break even point $208.45

Loss below $208.45 without roll over to lower strike.

Almost 3.00% income from $21,945 initial investment = $658 within 7 trading days. That's not too shabby when you are retired.

Let's see if this dry trade will be profitable and hopefully I don't have to use roll over, although I would like to try this tactic some day soon.

Again, if you have any questions, please use comment form below post.

Good luck to me :)

Short term covered call contract on $219.45 DIA long position with strike $215 for premium $1100.

Expiration date 04-09-2020, Thursday, that's just 7 trading days away

Possible Income 2.98 %

Break even point $208.45

Loss below $208.45 without roll over to lower strike.

Almost 3.00% income from $21,945 initial investment = $658 within 7 trading days. That's not too shabby when you are retired.

Let's see if this dry trade will be profitable and hopefully I don't have to use roll over, although I would like to try this tactic some day soon.

Again, if you have any questions, please use comment form below post.

Good luck to me :)

that was one of my first try dry trades on covered calls, I made money on it, but I think I made mistake because this call was in the money based on my bearish assumption that stock will go down soon. ...If I sold out of the money call, I would collect less in the premium, but I would also profit on price difference if strike price was $225 or $230

ReplyDeleteOf course, this contract was executed at strike $215, I misjudged tend, but still I was able to make $658, Next week I am going to try to sell cash secured out of the money put option with expiration April 17th or April 24th ?

ReplyDelete