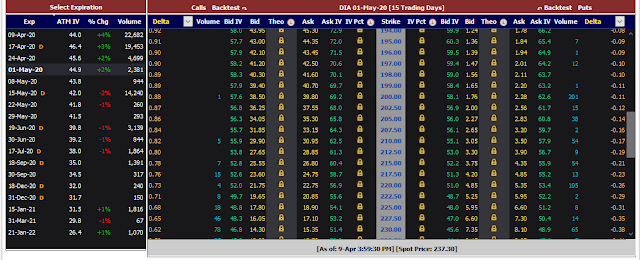

4/09/2020 DIA cash secured PUT May 1st

Put trade:

At the moment I don't have any long position, so I can not sell covered calls, yet I don't like idea of money sitting on the sideline and not working for me.

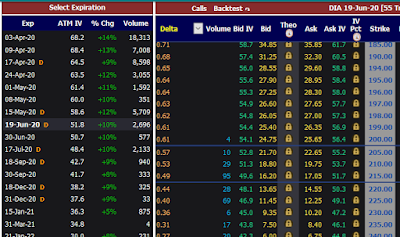

I decided to try to sell cash secured DIA put option.

How does it works ?

I am selling cash secured May 1st $215 strike put option for $420 premium, that means, if price falls below $215 between now and May 1st, I will be forced to buy 100 shares of DIA stock at $215 per share for total $21,500.- $420 premium I already collected, so my basic cost per share will be $210.80.

If option get exercised at $215 and I end up holding 100 shares of DIA,- what can I do next?

I can sell covered call for another premium $xxx .

If stock stays above $215, I will keep $420 and rest of cash.

P.s. This is another training trade (try and Dry), no real money risked here .

At the moment I don't have any long position, so I can not sell covered calls, yet I don't like idea of money sitting on the sideline and not working for me.

I decided to try to sell cash secured DIA put option.

How does it works ?

I am selling cash secured May 1st $215 strike put option for $420 premium, that means, if price falls below $215 between now and May 1st, I will be forced to buy 100 shares of DIA stock at $215 per share for total $21,500.- $420 premium I already collected, so my basic cost per share will be $210.80.

If option get exercised at $215 and I end up holding 100 shares of DIA,- what can I do next?

I can sell covered call for another premium $xxx .

If stock stays above $215, I will keep $420 and rest of cash.

P.s. This is another training trade (try and Dry), no real money risked here .

Comments

Post a Comment