3-31@4-9 Roll over option from 215 to 200

Fool's Day trading....?

D Trade on April 9th 2020 covered call

Well, DIA closed down today at $209.38 on low volume as downturn could be expected, but with stocks you never know.

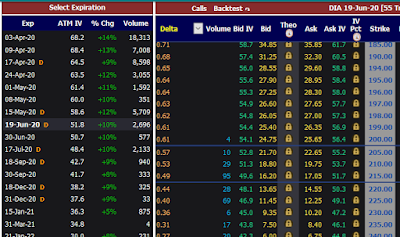

To stay in the money I did roll over with my covered DIA call option from $215 strike at $6.00, down to $200 strike for $14.5 premium.

So, from initial trade at $11 I bought it back at $6.00 for $5.00 profit + I sold $200 strike at $14.5, making my total premiums go up to +$20.5 which lowered my break even point down to $199 on $219.45 investment .

Still, six trading days to go.... on this 4/09 position

p.s. blogger has some problems with posting comments ... sorry

D Trade on April 9th 2020 covered call

Well, DIA closed down today at $209.38 on low volume as downturn could be expected, but with stocks you never know.

To stay in the money I did roll over with my covered DIA call option from $215 strike at $6.00, down to $200 strike for $14.5 premium.

So, from initial trade at $11 I bought it back at $6.00 for $5.00 profit + I sold $200 strike at $14.5, making my total premiums go up to +$20.5 which lowered my break even point down to $199 on $219.45 investment .

Still, six trading days to go.... on this 4/09 position

p.s. blogger has some problems with posting comments ... sorry

I think I made some kind of mistake on this trade , I need to figure out why and where ?

ReplyDeleteTo keep related trades in same group, I need to give them relating names eg. D trade, so they can be found easily in search engine.

ReplyDelete