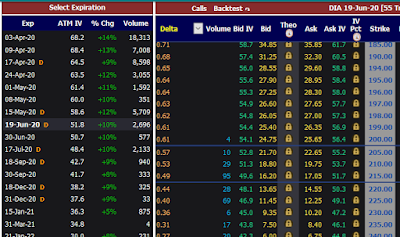

June 20 Roll over from 220 to 195

June 2020 covered call option dry try transactions

To keep DIA covered call in the money, I rolled over it from $220 down to $195 strike

So, I bought back June 2020 $220 strike at $14 and sold $195 covered call for June 2020 at $28.

On $223 initial investment , I collected covered $22 premium - $14 buy back and + $28 in new covered call option premium = $36 in total premium

That gives me break even point from $223 initial investment at $187

To keep DIA covered call in the money, I rolled over it from $220 down to $195 strike

So, I bought back June 2020 $220 strike at $14 and sold $195 covered call for June 2020 at $28.

On $223 initial investment , I collected covered $22 premium - $14 buy back and + $28 in new covered call option premium = $36 in total premium

That gives me break even point from $223 initial investment at $187

Comments

Post a Comment