SSL June 19th $2.5 Sell Put for $0.60

SSL Put to sell, cash secured

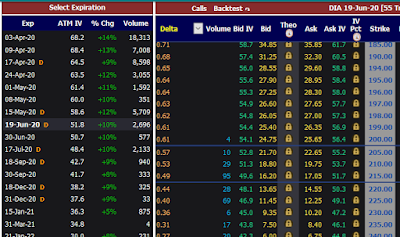

This option premium looked very attractive when stock was trading at $3.16 a share, So I decided to sell cash secured 10 contracts with strike at $2.50 and premium $0.60 which translates to total income of $600 for waiting time until expiration date on June 19th.

High percentage return of 24% within 8 weeks is worth the risk of SSL going below $2.5 a share, but if it does happen and my contracts get executed and me ending holding 1000 shares of SSL, I will turn around and sell another 10 contract of covered calls.

Technical look good for SSL, seems like it is building base for sharp move to the upside, also, I think all the negativity in oil market has been already calculated in price of the stock, besides, Sasol should be fully benefiting from Lake Charles plant designed to make chemicals. This plant when fully operational will boost Sasol bottom lines and contribute greatly to revenues with good profit margins and in US dollars.

This option premium looked very attractive when stock was trading at $3.16 a share, So I decided to sell cash secured 10 contracts with strike at $2.50 and premium $0.60 which translates to total income of $600 for waiting time until expiration date on June 19th.

High percentage return of 24% within 8 weeks is worth the risk of SSL going below $2.5 a share, but if it does happen and my contracts get executed and me ending holding 1000 shares of SSL, I will turn around and sell another 10 contract of covered calls.

Technical look good for SSL, seems like it is building base for sharp move to the upside, also, I think all the negativity in oil market has been already calculated in price of the stock, besides, Sasol should be fully benefiting from Lake Charles plant designed to make chemicals. This plant when fully operational will boost Sasol bottom lines and contribute greatly to revenues with good profit margins and in US dollars.

Comments

Post a Comment