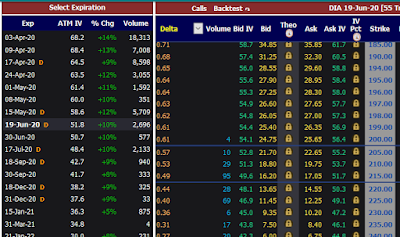

April 03-2020 $210 strike at $4.70 C

C Trade, Slightly out of the money.

Short term covered call option for quick income.

04/03 expiration, sold when DIA was trading at $209.50 for $210 strike at $4.70 premium with expiration 2 days away.

If DIA closes below $210 on 04/03 this option will expire worthless, I will pocket $470 premium and retain stock for roll over.

If DIA closes above $210, I will keep $470 premium, option will get exercised at $210 . total profit on this transaction will be about 2.25% within 2 days.

With $21,470 on hand I can be back in the market in no time.

I am researching now short term covered call DIA index options .

Possible risk is that DIA will take dive below $200 and will continue in down trend, affecting negatively value of my account. .... Still learning ...

Short term covered call option for quick income.

04/03 expiration, sold when DIA was trading at $209.50 for $210 strike at $4.70 premium with expiration 2 days away.

If DIA closes below $210 on 04/03 this option will expire worthless, I will pocket $470 premium and retain stock for roll over.

If DIA closes above $210, I will keep $470 premium, option will get exercised at $210 . total profit on this transaction will be about 2.25% within 2 days.

With $21,470 on hand I can be back in the market in no time.

I am researching now short term covered call DIA index options .

Possible risk is that DIA will take dive below $200 and will continue in down trend, affecting negatively value of my account. .... Still learning ...

I still can not grasp advantage of rolling over in the money covered call options, may be there in none ..April 2nd 11:45 am ...Florida

ReplyDeleteDIA closed at $213.96, $210 strike at $4.95 ....trade so far is profitable as of April 2nd at 4:15 pm

DeleteDIA closed at $210.60 and covered call option with strike $210 was executed, therefor my total profit on this trade came to $470 in premium + $50 in price difference between 209.5 and $210 = $520 just in 3 days. Right now I don't have long position, but I look forward to tomorrow to go long on DIA and again sell covered call with expiration on April 9th. Let's hope this will be profitable trade too. Thank you

ReplyDelete